As we now know, cryptocurrencies are unique and encoded “coins” stored in a blockchain ledger. Technology blockchain (distributed ledger or blockchain) allows the creation and mining of cryptocurrencies and this ledger not only documents all transactions between participants but also the origin of these coins. Like money provided by central banks, cryptocurrencies are created on different networks (Bitcoin, Ethereum, etc.), but this according to open-source software in a digital and decentralized process rather than in a centralized process as happens in traditional central banks.

In November 2021 the cTotal market capitalization of all cryptocurrencies is estimated to be around $ 2.5 trillion and bitcoin alone represents about $ 1 trillion.

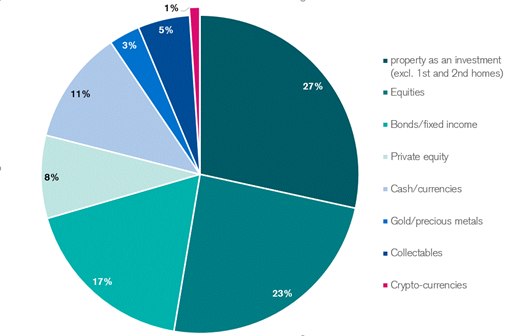

As evidenced by the report “Distributed Ledger Technology (DLT) and crypto assets” by Credit Suisse, cryptocurrencies have become, in many countries, an integral part of the private portfolios of “high net worth individuals“(UHNWI). On average in all countries, cryptocurrency allocations have been estimated at 1% of total allocations.

Confirming the growing attention towards cryptocurrencies, the Capgemini World Wealth Report 2021, which is based on a survey conducted on over 2,900 wealthy individuals in 26 countries, finds that 72% of respondents invested in cryptocurrencies, while 74% in other digital assets such as website domain names.

A recent poll found that 41.51% of all people invested in bitcoin are millennials aged between 25 and 35 years. Cryptocurrencies therefore exert a particular fascination for the new generations who are more critical than the previous ones towards the traditional financial system thanks to the great financial crisis of 2008. Young investors, despite the very high volatility, are attracted by the strong appreciation of some cryptocurrencies, in fact, bitcoin from a price close to zero in 2010 is now more than $ 57,000.

In the United States, a recent survey estimates that 46 million people (22% of adults) already own bitcoin and 80% would move their crypto assets to their bank if it offered them safe storage space.

Crypto and portfolio volatility

Credit Suisse analysts have created a hypothetical balanced wallet, in which they included bitcoin in alternative investments and in parallel reduced their holdings in hedge funds. The results show that with an allocation of 2%, 5% and 10% in bitcoin, the expected volatility of the portfolio is respectively 9.1%, 13.5% and 22.6%. A portfolio volatility therefore much higher than their current balanced portfolio which has an expected volatility of 7.6%.

A relatively small allocation of 2% in bitcoin within a balanced USD portfolio it would already represent 25% of the total portfolio risk.

THE sudden drawdowns, in certain periods, bitcoin puts it at a disadvantage compared to the asset classes, in fact, in the last ten years, bitcoin has registered three cases of 80% drawdown within 18 months of the previous peak.

What the technical analysis says

Credit Suisse does not provide fundamental analysis of cryptocurrencies as it finds it difficult to estimate values or forecasts. From a technical analysis standpoint, bitcoin’s relentless uptrend since March 2020, albeit still intact, “has grown significantly tired”, with the weekly relative strength index unable to confirm the latest push towards new highs. . These latter highs themselves are also limited to this year’s April resistance, now seen at USD 70,000.

“The subsequent fall has already brought bitcoin back to what can be seen as key long-term supports from its 200-day average and September low of USD 46,445 and USD 36,925, respectively. For now, if this key support cluster holds up, it would define the lower end of a broader side stage, ”the Credit Suisse experts remark, adding. “A weekly close below the low of $ 36,925 in September, however, would mark the first significant sign that a more lasting peak may be in place. The key support to monitor would therefore be the low of USD 28,825 in June, as a break below this pivotal level would mark a significant change in the downtrend ”. Instead, a weekly close above USD 70,000 would be needed to suggest that the underlying uptrend may regain upward momentum, with a resistance later seen at $ 81,000.